You're here:

Sales tax by state: Rates and state-by-state guides

As a business owner selling products or services, you have to keep legal compliance in mind. If anything, you have to stay on top of your tax obligations. That's where sales tax comes into play.

This page explains what you need to know about sales tax in the US. Read on to specifically learn more about state and local tax rates, including the five states without sales tax at all.

Overview of state and local sales tax

As cited, a sales tax is a mandatory payment imposed by state and local governments on the sale of products and services. In fact, sales tax is a top source of revenue for most states in the country. The revenue is primarily used to fund public services, such as infrastructure, schools, hospitals, parks, and other government projects.

Understanding sales tax by state is crucial for businesses, because a one-size-fits-all approach doesn't work. While some states offer tax holidays or don't charge sales tax at all, the rules surrounding what's taxable within a single state can vary.

For example, the state of Illinois doesn’t tax SaaS products, but the city of Chicago (which is inside Illinois) does have a tax on SaaS products!

If you're interested in how US sales tax works and how to comply, here's a quick overview:

- Start by staying abreast with your state and local sales tax policies.

- Find out if what you’re selling (or how you’re selling it) is taxable, then track your sales to see if you have a sales tax nexus, which triggers your obligations.

- Once you do, you must register, charge sales tax, and file returns on time.

For now, here's what you need to know about the state and local sales tax rates.

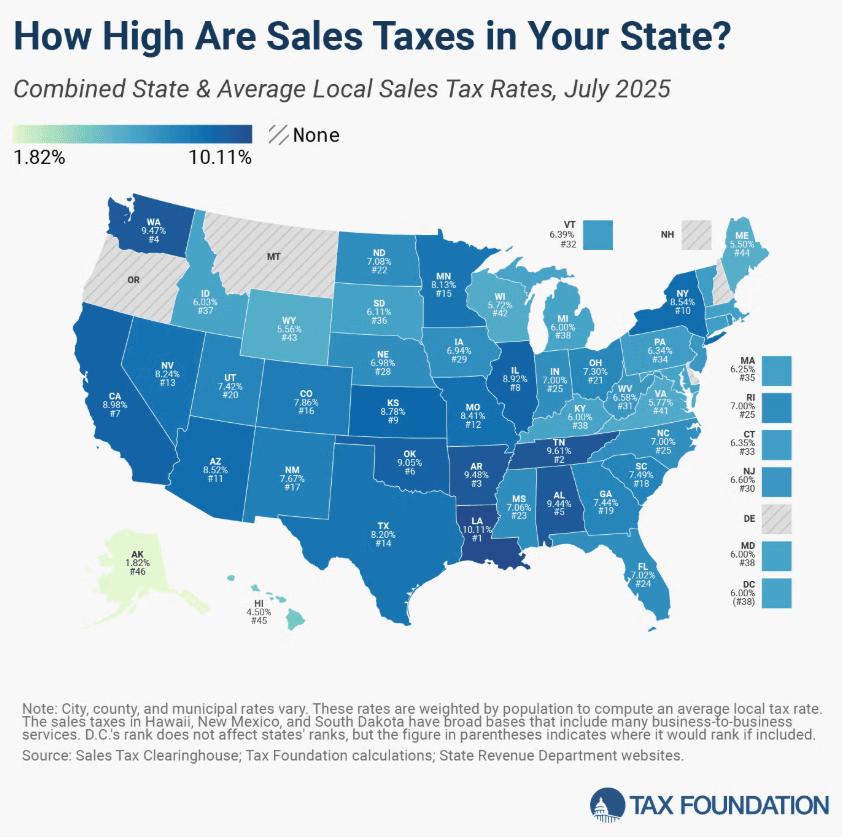

State-by-state sales tax map

Have a peek at the combined state and average local sales tax rates as of July 2025:

State sales tax rates

Here are the highest and lowest state-level tax rates:

- Highest: California leads with 7.25%.

- Second highest: Indiana, Mississippi, Rhode Island, and Tennessee follow at 7%.

- Lowest non-zero: Colorado stands at 2.9%.

- Second lowest: Alabama, Georgia, Hawaii, New York, and Wyoming come next at 4%.

Each state sets its own base sales tax rate. However, local governments, such as counties and cities, add their rates on top. Plus rates can change from time to time.

Local sales tax

Not only do most states charge a sales tax, they also allow local governments to add their own. This can significantly raise the total sales tax consumers pay.

While 45 states collect statewide sales tax, about 38 states allow local jurisdictions to add their own tax. These five states have the highest average local rates:

- Alabama: 5.44%

- Louisiana: 5.11%

- Colorado: 4.96%

- Oklahoma: 4.55%

- New York: 4.54%

In some places, these local add-ons can cause even moderate state tax rates to balloon into some of the highest combined rates in the country.

In real estate, direct sales tax on property sales is rare, but other taxes often apply. While most states don't tax the sale of real property, many charge transfer taxes based on the property's value when the deal is recorded.

Anna Zhang, Head of Marketing at U7BUY, says, “Businesses leasing or renting out tangible property related to real estate may also be subject to local sales tax on rental income. If you're buying or managing commercial property, understand all applicable taxes to stay compliant and avoid any unexpected costs or penalties”.

Sales and local combined tax rates by state

Sales tax rates vary from 0% to over 10%, depending on the state and the local add-ons. Many states with a low base rate still end up with high total taxes due to city, county, and other district-level surcharges. Take a look at the average combined sales tax rates nationwide:

- Nationwide average (population-weighted): from 7.49% to 7.52%

- Excluding no-tax states: from 7.49% to 7.72%

To make smarter tax decisions, examine both state and local sales tax rates together. High local add-ons can offset a low state rate, so checking the combined rate gives a clearer view. This broader look also helps when managing multi-state sales tax compliance.

That said, here's a snapshot of how states compare based on state tax, local tax, and combined totals.

2025 Sales Tax Rates | Sales Taxes by State

| State | State Tax Rate | State Tax Rank | Avg. Local Tax Rate | Max Local | Combined Tax Rate | Combined Rank |

|---|---|---|---|---|---|---|

| Alabama | 4% | 40 | 5% | 11% | 9% | 5 |

| Alaska | 0% | 46 | 2% | 8% | 2% | 46 |

| Arizona | 6% | 28 | 3% | 5% | 9% | 11 |

| Arkansas | 7% | 9 | 3% | 6% | 9% | 3 |

| California (a) | 7% | 1 | 2% | 5% | 9% | 7 |

| Colorado | 3% | 45 | 5% | 8% | 8% | 16 |

| Connecticut | 6% | 12 | 0% | 0% | 6% | 33 |

| Delaware | 0% | 46 | 0% | 0% | 0% | 47 |

| Florida | 6% | 17 | 1% | 2% | 7% | 24 |

| Georgia | 4% | 40 | 3% | 5% | 7% | 19 |

| Hawaii (b) | 4% | 40 | 1% | 1% | 5% | 45 |

| Idaho | 6% | 17 | 0% | 3% | 6% | 37 |

| Illinois | 6% | 13 | 3% | 5% | 9% | 8 |

| Indiana | 7% | 2 | 0% | 0% | 7% | 25 |

| Iowa | 6% | 17 | 1% | 2% | 7% | 29 |

| Kansas | 7% | 9 | 2% | 4% | 9% | 9 |

| Kentucky | 6% | 17 | 0% | 0% | 6% | 38 |

| Louisiana | 5% | 32 | 5% | 7% | 10% | 1 |

| Maine | 6% | 29 | 0% | 0% | 6% | 44 |

| Maryland | 6% | 17 | 0% | 0% | 6% | 38 |

| Massachusetts | 6% | 13 | 0% | 0% | 6% | 35 |

| Michigan | 6% | 17 | 0% | 0% | 6% | 38 |

| Minnesota | 7% | 6 | 1% | 3% | 8% | 15 |

| Mississippi | 7% | 2 | 0% | 1% | 7% | 23 |

| Missouri | 4% | 38 | 4% | 6% | 8% | 12 |

| Montana (c) | 0% | 46 | 0% | 0% | 0% | 47 |

| Nebraska | 6% | 29 | 1% | 2% | 7% | 28 |

| Nevada | 7% | 7 | 1% | 2% | 8% | 13 |

| New Hampshire | 0% | 46 | 0% | 0% | 0% | 47 |

| New Jersey (d) | 7% | 8 | -0% | 3% | 7% | 30 |

| New Mexico (b) | 5% | 35 | 3% | 5% | 8% | 17 |

| New York | 4% | 40 | 5% | 5% | 9% | 10 |

| North Carolina | 5% | 36 | 2% | 3% | 7% | 27 |

| North Dakota | 5% | 32 | 2% | 4% | 7% | 22 |

| Ohio | 6% | 27 | 2% | 2% | 7% | 21 |

| Oklahoma | 5% | 37 | 5% | 7% | 9% | 6 |

| Oregon | 0% | 46 | 0% | 0% | 0% | 47 |

| Pennsylvania | 6% | 17 | 0% | 2% | 6% | 34 |

| Rhode Island | 7% | 2 | 0% | 0% | 7% | 25 |

| South Carolina | 6% | 17 | 1% | 3% | 7% | 18 |

| South Dakota (b) | 4% | 39 | 2% | 5% | 6% | 36 |

| Tennessee | 7% | 2 | 3% | 3% | 10% | 2 |

| Texas | 6% | 13 | 2% | 2% | 8% | 14 |

| Utah (a) | 6% | 16 | 1% | 5% | 7% | 20 |

| Vermont | 6% | 17 | 0% | 1% | 6% | 32 |

| Virginia (a) | 5% | 31 | 0% | 3% | 6% | 41 |

| Washington | 7% | 9 | 3% | 4% | 9% | 4 |

| West Virginia | 6% | 17 | 1% | 1% | 7% | 31 |

| Wisconsin | 5% | 32 | 1% | 3% | 6% | 42 |

| Wyoming | 4% | 40 | 2% | 3% | 6% | 43 |

| District of Columbia | 6% | 0% | 0% | 6% |

Which state has the highest sales tax?

The five states with the highest average combined state and local sales tax rates are:

- Louisiana (10.11%)

- Tennessee (9.61%)

- Arkansas (9.48%)

- Washington (9.47%)

- Alabama (9.44%)

What do higher sales tax rates mean for businesses?

Stanislav Khilobochenko, VP of Customer Services at Clario, recommends keeping a close eye on combined tax rates. He cites that this is especially important when operating in high-tax states in the country.

Khilobochenko says, "Sales tax can add up fast in places like Louisiana or Tennessee. For B2B companies, understanding the full tax picture helps avoid pricing issues and keeps transactions smooth for both sides. Taking the time to analyze combined rates ensures you're not caught off guard by extra costs that can impact profitability."

Which state has the lowest sales tax?

The five states with the lowest average combined rates are:

How can businesses capitalize on lower sales tax rates?

Adrian Lorga, Founder and President at 617 Boston Movers, suggests factoring in lower-tax states when planning business operations or expansion. They also plan to expand their moving company to these locations in the future to cater to the local needs.

Lorga explains, "Lower combined rates in states like Alaska or Maine can make a real difference in overall costs. It's a smart move for service-based businesses looking to stay competitive and efficient. Understanding these tax advantages helps companies optimize pricing, improve margins, and allocate resources more strategically."

States with no sales tax, the NOMAD states

While 45 states and Washington, D.C. collect statewide sales tax and 38 allow local sales taxes, five states stand out for not charging any statewide sales tax. These are known as the "NOMAD" states:

- New Hampshire has no sales tax. Its income tax is limited to interest and dividend earnings. However, the state has one of the highest property tax rates in the US

- Oregon doesn't charge sales tax. But if you buy a car out of state and register it locally, you'll need to pay an excise tax.

- Montana has no state sales tax, but tourist towns like Big Sky can charge local sales taxes.

- Alaska has no state sales or income tax, making it a highly tax-friendly state. Still, over 100 local areas charge sales tax, and many require remote sellers to collect it if they meet nexus rules.

- Delaware skips state sales tax but does impose a gross receipts tax on businesses based on total revenue from goods and services sold.

For businesses, selling goods or items in NOMAD states means daily consumer purchases are generally tax-free. As such, they can simplify operations like calculating and preparing a tax invoice.

Leigh McKenzie, Community Advocate at Traffic Think Tank, however, emphasizes the need to understand the local or specialty taxes involved in the abovementioned states. She mentions that these taxes may still apply depending on the area or type of transaction.

McKenzie shares, "Working with B2B clients, we often see that taxes are a big concern, especially when delivering products or services across state lines. States with no sales tax can seem simpler, but it's important to understand the local rules that might still apply, so nothing catches your team off guard."

Sales tax guides by state

If you need to dive deeper into sales tax by state rules and how products are taxed there, then check out some of these state-by-state sales tax guides below.

- Alabama Sales Tax Guide

- Alaska Sales Tax Guide

- Arizona Sales Tax Guide

- Arkansas Sales Tax Guide

- California Sales Tax Guide

- Colorado Sales Tax Guide

- Connecticut Sales Tax Guide

- Delaware Sales Tax Guide

- Florida Sales Tax Guide

- Georgia Sales Tax Guide

- Hawaii Sales Tax Guide

- Idaho Sales Tax Guide

- Illinois Sales Tax Guide

- Indiana Sales Tax Guide

- Iowa Sales Tax Guide

- Kansas Sales Tax Guide

- Kentucky Sales Tax Guide

- Louisiana Sales Tax Guide

- Maine Sales Tax Guide

- Maryland Sales Tax Guide

- Massachusetts Sales Tax Guide

- Michigan Sales Tax Guide

- Minnesota Sales Tax Guide

- Mississippi Sales Tax Guide

- Missouri Sales Tax Guide

- Montana Sales Tax Guide

- Nebraska Sales Tax Guide

- Nevada Sales Tax Guide

- New Hampshire Sales Tax Guide

- New Jersey Sales Tax Guide

- New Mexico Sales Tax Guide

- New York Sales Tax Guide

- North Carolina Sales Tax Guide

- North Dakota Sales Tax Guide

- Ohio Sales Tax Guide

- Oklahoma Sales Tax Guide

- Oregon Sales Tax Guide

- Pennsylvania Sales Tax Guide

- Rhode Island Sales Tax Guide

- South Carolina Sales Tax Guide

- South Dakota Sales Tax Guide

- Tennessee Sales Tax Guide

- Texas Sales Tax Guide

- Utah Sales Tax Guide

- Vermont Sales Tax Guide

- Virginia Sales Tax Guide

- Washington Sales Tax Guide

- Washington, D.C. Sales Tax Guide

- West Virginia Sales Tax Guide

- Wisconsin Sales Tax Guide

- Wyoming Sales Tax Guide

City sales tax guides

If you're selling in a major city in the US, you likely have to deal with particular local rules. Check out some of these sales tax guides by city.

- Atlanta Sales Tax Guide for Businesses

- Austin Sales Tax Guide for Businesses

- Boston Sales Tax Guide for Businesses

- Chicago Sales Tax Guide for Businesses

- Dallas Sales Tax Guide for Businesses

- Denver Sales Tax Guide for Businesses

- Houston Sales Tax Guide for Businesses

- Los Angeles Sales Tax Guide for Businesses

- Nashville Sales Tax Guide for Businesses

- New York Sales Tax Guide for Businesses

- Orlando Sales Tax Guide for Businesses

- Philadelphia Sales Tax Guide for Businesses

- Phoenix Sales Tax Guide for Businesses

- San Francisco Sales Tax Guide for Businesses

- Seattle Sales Tax Guide for Businesses

- Tampa Sales Tax Guide for Businesses

- Washington, DC Sales Tax Guide for Businesses

What can help with sales tax compliance by state?

Looking to stay on top of your state and local sales tax? Quaderno offers end-to-end tax compliance software for online businesses, helping you manage your taxes from monitoring nexus thresholds to point-of-sale calculations to reporting and filing. Sign up today for a week-long free trial!

Note: At Quaderno we love providing helpful information and best practices about taxes, but we are not certified tax advisors. For further help, or if you are ever in doubt, please consult a professional tax advisor or the tax authorities.