In this article

- Types of sales tax around the world

- Are digital products taxable?

- VAT on digital products and services

- Do I charge sales tax on digital products in the US?

- Which US states tax digital goods?

- Which other countries tax digital goods?

- Are you liable for these digital taxes?

- How to register for sales tax in different countries

- How to calculate sales tax and how to collect it

- How to record and document sales tax activity

- How to file sales tax returns

- Accounting and tax compliance

- Last word

“Is my digital good taxable?” That’s the question on the minds of entrepreneurs around the world.

And it’s a crucial question, too.

Digital sales tax laws are evolving all the time, almost as fast as technology is innovating. Countries introduce new tax rules to capitalize on this booming economy. Definitions of a “digital good” or “digital product” change from region to region, or state to state.

It’s a lot for business owners to learn, absorb, monitor, and comply with. Let’s face it: you want to grow your business and focus on your customers. You don’t want a part-time job in tax policy.

That’s why we created this guide.

Here’s everything you need to know about taxability of digital goods, kept up-to-date by our team of tax maniacs.

Types of sales tax around the world

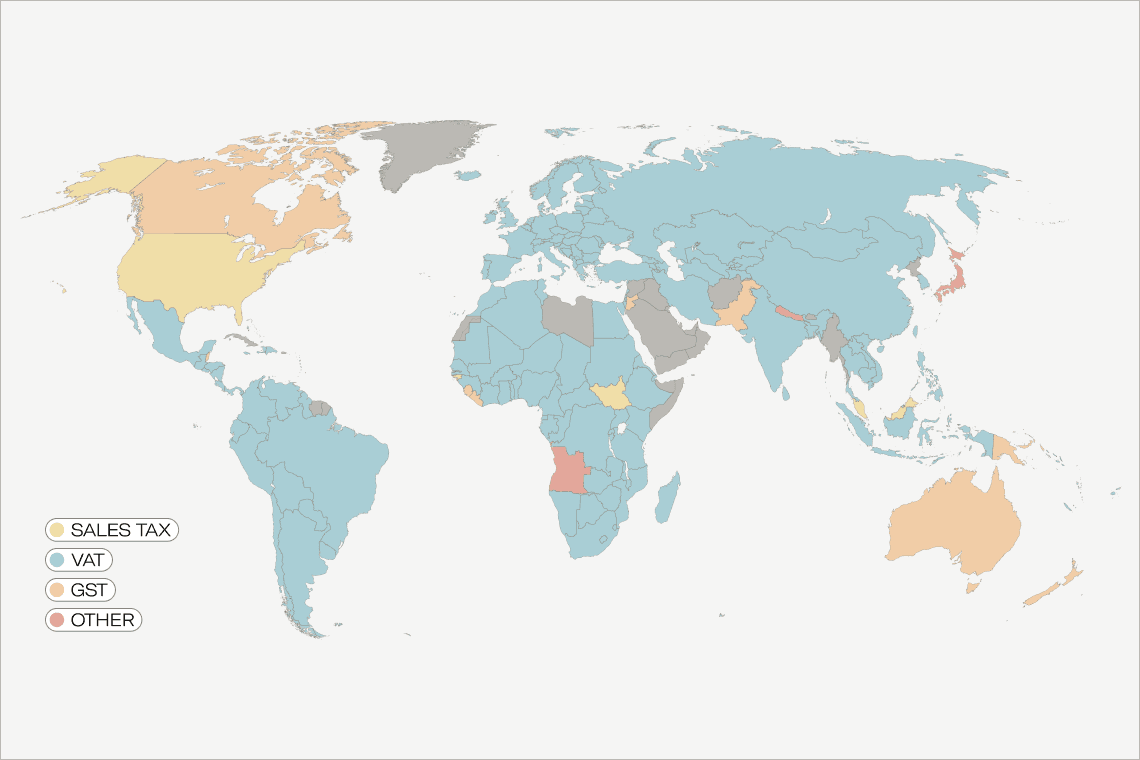

Nearly every country in the world applies a consumption tax to sales of goods and services.

There are different kinds of consumption taxes, depending on the country. It can be a flat rate applied to every transaction, or a percentage of the total value. Each type requires something different from you, the business owner.

But one element always stays the same. The end customer pays the tax, because they are who’s actually consuming the end product. And it’s a tax on consumption, on buying for one’s personal use.

Consumption taxes go by a few different names, because they can each function a little differently. There’s the Value-Added Tax in the European Union, and the Goods and Services Tax in Australia. These are better known as VAT and GST. Most countries have one or the other.

The United States has a style of its own. North American “sales tax” is a consumption tax that’s theoretically only charged once, at the final purchase of the final product by the end consumer.

However, the country has no national level sales tax. Instead, sales tax is determined and controlled by each individual state. This creates a lot of complexity in the US sales tax system.

- 45 states and the District of Columbia collect statewide sales taxes. Alaska, Delaware, Montana, New Hampshire, Oregon do not have any sales tax at all, and are referred to as the NOMAD states.

- 38 states have some form of local sales tax, collected in part or all of the state.

The result is that there are thousands of taxing jurisdictions in the United States!

Plus, many US states use a secondary tax system to capture more revenue from sales, called Use Tax.

Use tax is specifically designed to collect tax dollars on purchases even when businesses aren’t liable for sales tax in that state. Since the government can’t force those businesses to collect Sales tax, the government turns to the in-state customers to pay Use tax.

The in-state customers have to pay a little tax for whatever taxable products they purchase outside of state and bring home. So, in a sense, the states are taxing the use of the product.

The rule of thumb is that if you aren’t liable for sales tax somewhere, then you’re probably expected to comply with the use tax rules instead.

Are digital products taxable?

First we should establish what exactly a “digital product” is. But first let’s cover the other terms used to refer to them, too. These include:

- Digital products

- Digital service

- Electronic good or electronic service

- E-good or e-service

They’re essentially all the same thing. For the sake of this article, we’re going to stick with the term “digital product” or occasionally “digital service.”

The truth is that the definition of “digital product” is elastic. Any place you go in the world, and within the 50 states of the US, will have its own version of the definition, making small additions or omissions in what’s considered a digital product. For example, some jurisdictions consider online newspaper subscriptions to be digital services, and other places don’t.

Some basic characteristics stay the same. Here’s how we can generally describe a digital product:

You receive it via the internet. It arrives in an email, or you download it from a website, or you access it by logging into an online portal. This product originates from and lives in the digital space and has been made by a digital creator.

Here’s a list of common digital products on the market today. BUT — since the definitions can be quite detailed and various, please do not assume that everything on this list is considered a “digital good” everywhere.

- E-books, images, movies, and videos, whether buying a copy off of Amazon or using a service like Netflix. In tax language, these products are in a category usually called, “Audio, visual, or audio-visual products.”

- Online courses, or e-Learning materials that fit certain qualifications.

- Downloadable and streaming music, whether buying an MP3 or using a service like SoundCloud or Spotify. Of course, these products also fall in the audio category.

- Cloud-based software and as-a-Service products, such as Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS). (Although these products can have their own specific SaaS tax rules)

- Websites, site hosting services, and internet service providers.

VAT on digital products and services

There is VAT on digital services and products in the EU if the product matches the following four characteristics, according to European Union digital tax rules:

- It is not a physical, tangible good.

- It’s essentially based on IT. The offering could not exist without technology.

- It’s provided via the Internet or an electronic network.

- It’s fully automated or involves minimal human intervention.

Do I charge sales tax on digital products in the US?

Yes, digital goods are taxable in the US, depending on the state. Sales tax for digital goods in the US largely comes down to how each state defines “digital good” versus the old-school idea of “tangible personal property”, and whether your product fits that definition.

From a tax perspective, there are 6 types of digital goods:

- Online data processing services.

- Downloaded software.

- Downloaded books, such as eBooks and Kindle.

- Downloaded music, digital audio files such as iTunes and podcasts.

- Downloaded movies or digital video, such as Netflix and Amazon Prime.

- Other downloaded electronic goods.

Not all states tax all of those listed above. Again, it depends on each state’s definition. There are basically three scenarios:

1. States not using any definition at all

There are 18 states that don’t specifically define digital goods: Alabama, Arizona, California, Colorado, D.C., Florida, Hawaii, Idaho, Maryland, Massachusetts, Missouri, New Mexico, New York, Pennsylvania, South Carolina, South Dakota, Utah and Virginia.

2. States using their own definition

In addition to the general categories listed above, many states have their own definition of digital goods and services. These include: Arkansas, Connecticut, Georgia, Illinois, Iowa, Kansas, Louisiana, Maine, Michigan, Minnesota, Mississippi, North Carolina, Ohio, Oklahoma, Texas and West Virginia.

3. States using a standard definition

The remaining states share a standardized definition of digital goods: Indiana, Kentucky, Nebraska, New Jersey, Nevada, North Dakota, Rhode Island, Tennessee, Vermont, Washington, Wisconsin and Wyoming. This definition is called the Streamlined Sales Tax (SST) Definition of Digital Goods; further information about this is available online, e.g. on the Streamlined Sales Tax Governing Board’s website.

Which US states tax digital goods?

- Alaska

- Alabama

- Arizona

- Colorado

- Connecticut

- Hawaii

- Iowa

- Idaho

- Indiana

- Kentucky

- Louisiana

- Maine

- Minnesota

- Mississippi

- North Carolina

- Nebraska

- New Jersey

- New Mexico

- Ohio

- Pennsylvania

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Washington

- Washington DC

- Wisconsin

- Wyoming

For information about each state’s sales tax rules, check out the sales tax guides for each US state.

Important note: Given the growth rate of the digital economy, any states that don’t currently tax digital goods will probably figure out a way to do so very soon. These rules evolve rapidly. It’s best to double-check wherever you’re selling!

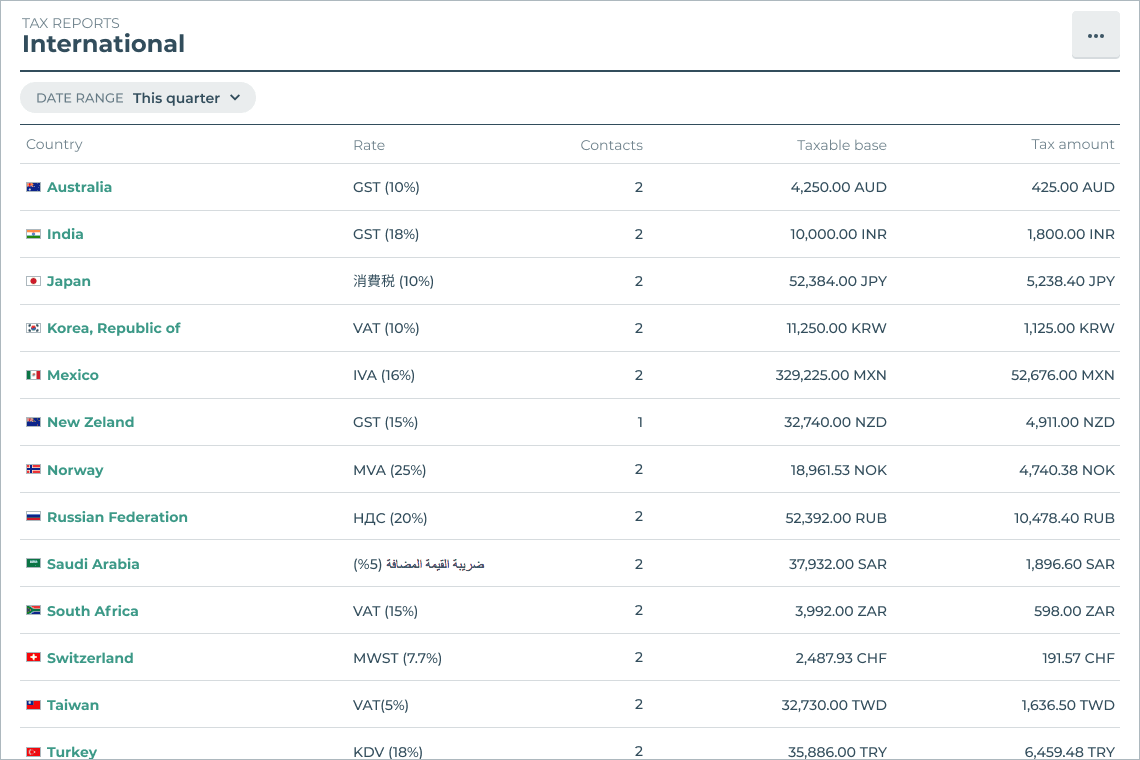

Which other countries tax digital goods?

Many other countries and regions tax digital products and are planning to introduce new laws. Here’s a map below, to help you gauge your tax liability at a glance. However, global digital tax rules are always evolving, so you should double-check in each of the other countries where you sell your goods.

Are you liable for these digital taxes?

Just because a country has VAT on digital services or a sales tax on a digital good – doesn’t necessarily mean you must start adding the tax to all of your sales!

Your liability for these taxes depends on 3 things:

- how much you sell

- your selling methods

- and where your business is based.

Tax registration thresholds

Tax liability also hinges on how much your business is selling. Obviously, when business booms, tax authorities want their cut! On the other hand, if you only sell a small to moderate amount, the authorities might not bother you with any tax burden.

This distinction in your sales is often called a tax threshold, or tax registration threshold.

The threshold is a fixed amount of money in that country’s currency. When your sales pass the threshold amount, your business is required to register for local taxes.

Which sales count? Typically, only the sales made to residents within that certain country.

In what time frame? Within any twelve-month period. Threshold definitions often refer to “annual sales,” but this can be misinterpreted as sales within a single calendar year. But some policies don’t mean it on a January-December basis. The “annual sales” could be the amount you sold in the last twelve months — or are projected to sell in the next twelve months.

For example, in Japan, you must register for Japanese consumption tax only if your sales surpass the annual threshold of JPY 10 million. (Or $93,170.)

But some countries require you to register for taxes as soon as you’ve done any business there at all.

For example, in the EU, the digital goods threshold is €0 (yes, that’s “zero euro”). So upon your first sale to an EU customer, you better hop to the VAT registration step!

Similarly there’s no tax registration threshold in India, so you must register for India’s GST after one sale. Other countries with no registration threshold include Russia, Turkey, and South Korea.

No matter what, you should check a country’s tax registration threshold before doing business there. If you notice an unexpected sale to a brand new country, you should immediately check the threshold rules.

Economic Nexus thresholds in the US

Ever since the South Dakota vs. Wayfair decision, US state governments are adopting a new policy to make remote/online sellers liable for sales tax.

Before this Supreme Court Wayfair decision, there was a decision called Quill, which ruled that state governments could only tax businesses that are physically located in the state. But with the dawn of the digital economy — when goods and services, tangible and digital, are sold online and transferred across borders instantaneously — Quill no longer made sense. State governments needed a way to recoup revenue in the new economic landscape.

Enter the economic nexus, the tax policy legalized by the Wayfair decision.

An economic nexus is a trigger for tax liability that’s determined by your business’ economic activity, i.e. - the amount of sales you make in a particular state.

The common threshold is $100,000 in annual sales. Some states have an addition threshold based on the number of sales, usually 200 separate transactions in one year. It’s best to check each state’s economic nexus thresholds.

Other forms of tax liability in the US

US sales tax liability is determined through nexus rules. The term “nexus” refers to a commercial connection in the state. Your business either has nexus in a state, or it doesn’t have nexus in a state. When you do have nexus, that means you’re obligated to collect tax on your sales there.

Types of nexus vary, based on where you’re physically located, what you sell, and how you market/sell it. Here are the names of existing sales tax nexus in the US:

- Physical presence nexus

- Affiliate nexus

- Click-through nexus

- Nexus via web cookies

How to register for sales tax in different countries

Once you’ve confirmed your tax liability, it’s time to register. Some countries have deadlines by which they expect you to register. For example, in India you have 30 days to register for GST once you’ve made your first sale.

Here’s a quick explanation of how you actually register for sales tax in foreign countries.

Tax registration in US: get a tax permit in each state where you have nexus

So, you have to start collecting sales tax, but you must have a valid US sales tax permit before you can legally collect anything. If you begin collecting sales tax without the permit, some states may consider this tax fraud. Exactly the opposite outcome you’re hoping to achieve by reading this article!

The good thing is that many states allow you to register online with their Department of Revenue. Usually you’ll either receive your sales tax permit number instantly, or within 10 business days. If you register via snail mail, it may take 2-4 weeks.

Here’s some standard information you’ll need when registering for a US sales tax permit:

- Your personal contact info

- Your business contact info

- Social security number (SSN) or Federal Employer Identification Number (FEIN) also known as Employer Identification Number (EIN)

- Business entity (sole-proprietor, LLC, S-Corp, etc.)

Note: You can register in all 24 SSUTA streamlined states at once, with one registration process. Sounds convenient, but this may come with some unnecessary tax liabilities. You’d likely end up liable for tax in some states even though you don’t have nexus there, simply because you’ve registered. Learn more on the SSUTA tax registration page.

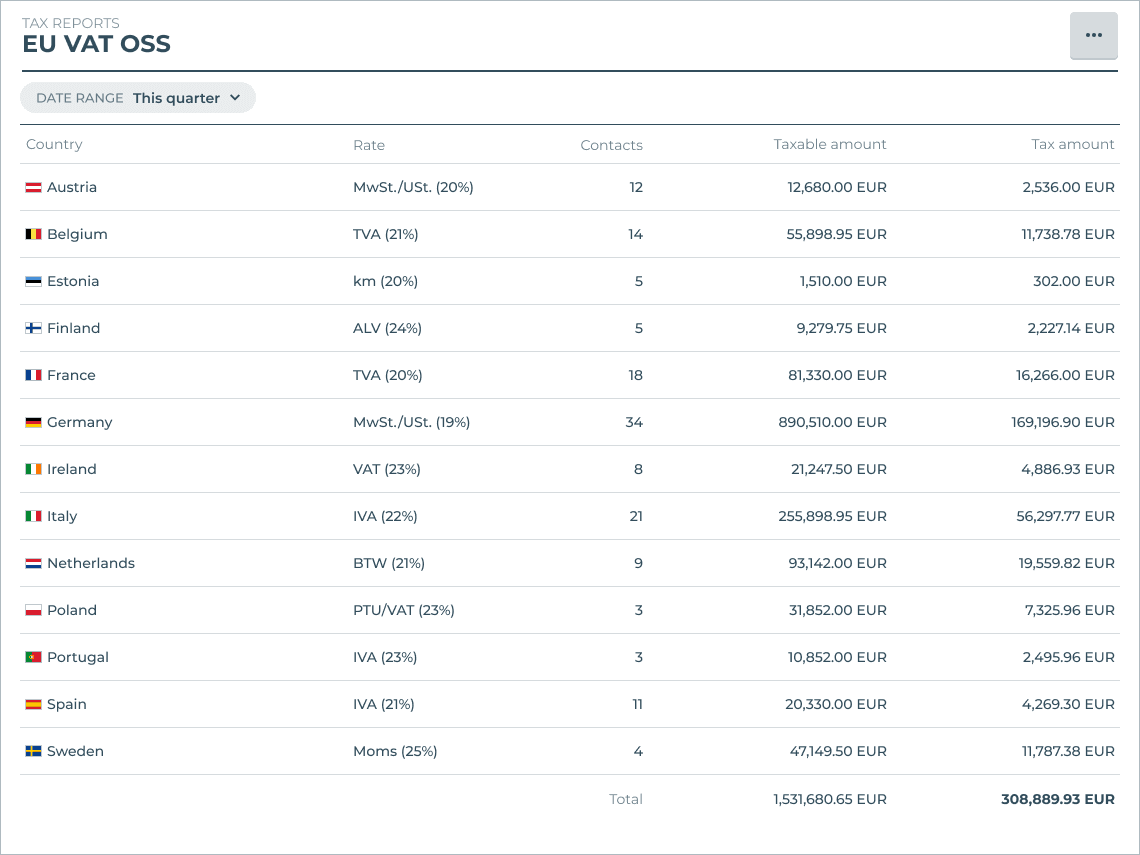

Tax registration in the EU: register in one member state via VAT OSS and receive an EU VAT number

Your business must have a VAT number to comply with EU VAT laws. Luckily it’s easy even for non-European businesses to get an EU VAT number.

The European Union came up with a brilliant (but not perfect) scheme for managing all member states’ taxes through one system: the VAT One-Stop Shop, or OSS. You register with the member state where you’re physically located, or if you’re not located anywhere in the EU, you can choose any EU country you like.

You register through the country’s VAT OSS online portal, and that country will serve as your VAT homebase.

VAT OSS exception for small EU B2C businesses

You are not required to register for VAT OSS if your business meets the following criteria:

You are an EU business, and you have less than €10,000 in cross-border B2C sales to other EU countries. In this case, you deal directly with your home tax authority and don’t use the OSS scheme.

However, as soon as you pass the €10,000 threshold, you should register for VAT OSS and abide by those rules.

Tax registration in other places around the world

Most other countries offer some kind of DIY simplified registration for foreign businesses. You can usually start the registration process through an online portal, or by sending an application form via email or snail mail. Then you’ll receive your VAT number or other tax ID via email or letter, with information about how to proceed.

However, a few places still require that you hire a local tax representative to handle the whole process. In those cases, you must select a local tax agent (or have one assigned by the government), authorize them to be your representative, and then let them register you for taxes.

Important note: Usually, once registered for sales tax in a country or state, you must continue to comply with tax laws each year, even if you don’t hit the threshold again the following year. You still have to comply because your business is a registered tax entity.

How to calculate sales tax and how to collect it

Once you’re registered and received the necessary ID numbers or permits, now you should actually apply tax to your transactions and collect that money from your customers. In other words, it’s go time!

The first step to consider is whether you should list your prices inclusive of taxes on your website. When selling to Australian customers, you’re required to by law.

Many countries don’t demand tax-inclusive pricing, so in those cases, it’s common to just apply taxes at checkout. But it’s a good idea to mention sales taxes ahead of time. Avoiding last-minute sticker shock is proven to increase conversions at checkout.

Calculate and collect in the US

- Confirm your buyer’s location.

- Calculate the tax rate based on the state law. See if the state has “origin-based” or “destination-based” tax rates.*

- Check all the tax rates that apply. There could be more levels than just a statewide sales tax! There may also be a county, city, or other local sales tax rate.

It seems simple, but there’s a lot of complexity within these three steps. A state can have very particular rules when it comes to taxing SaaS. For example, in Texas, only 80% of your revenue is subject to sales tax, and the other 20% is exempt. You can check each state’s tax authority website to check the policy first-hand.

- These are pretty much exactly what they sound like. “Origin-based” tax rules mean you use the tax rate from the origin of the provider (you!). So, the tax rate you apply to the sale must be the local rate(s) of wherever your business is located, if in the US. “Destination-based” means you use the tax rate of the destination of the product or service.

Calculate and collect in the EU

In the EU, the general rule is that you must apply the customer’s local tax rate. For example, if the buyer is located in Hungary, then apply the Hungarian VAT rate to the sale. (There are only a couple exceptions to that, which you’ll read about below.)

The key is to determine and confirm where exactly your EU customers are located.

Location evidence collection

Every business that’s registered for EU VAT must collect two pieces of customer location evidence to comply with EU tax laws.

The customer’s location determines the tax rate that you apply. If you don’t calculate and collect the right amount of tax from the buyer, then you are responsible for paying the difference!

So, you must collect two pieces* of evidence that confirm the location. This evidence could be:

- The billing address

- Location of the customer’s bank

- Country which issued the credit card

- The IP address location of the customer’s device

- Country of the SIM card (in cases where the purchase was made on a mobile device)

- If you’re a European business that sells below €100,000 in cross-border sales of digital goods per year, throughout the EU, then you only need to collect one piece of customer location evidence. But it must be a piece of evidence gathered from a third party, such as the bank or IP address, and not from the customer directly

Keep this location evidence on file for 10 years! These records prove that you are tax compliant, in case there’s ever an audit.

European businesses selling in the EU

If you’re a European business, you always charge VAT in your home country. Nothing else matters. You charge VAT on every sale of digital goods.

But when selling outside of your home country, there are differences in B2B and B2C.

Selling B2B in the EU

In B2B you don’t need to charge VAT; there is the reverse-charge mechanism wherein the buyer pays VAT to their own government. This saves you trouble, as you don’t have to file a separate tax return in each country where you make a sale. You just need to receive a valid VAT number, found using the VIES, from the buyer.

Selling B2C in the EU

As a European business selling B2C, you charge VAT to all customers. But the rate of VAT you charge depends on how much you’re selling within the EU.

If your business stays below €10,000 in cross-border sales of digital goods per year, throughout the EU, then your situation is different. You are not required to register for VAT OSS. If you don’t, then you can charge the VAT rate of your home country on all those cross-border sales.

Once you pass the €10,000 annual sales threshold, you must register for VAT OSS and charge the VAT rate of your customer’s country.

Non-European businesses selling in the EU

Simple rules apply for you! For B2B you should verify the buyer’s VAT number and then reverse-charge VAT. In B2C transactions, always charge the VAT of the customer’s country.

Calculate and collect in other countries

Calculating sales tax is a bit more straightforward because individual countries have a single national tax rate. As for how to collect it, a few of the steps remain the same as above.

- Verify the customer. Are they indeed located in that country? If they’re a business, can you validate their VAT/GST registration number?

- Add the correct tax amount and collect it at the point of sale.

Keeping up with the accurate tax rates around the world can be a huge hassle. There are tools, like Quaderno Checkout, that do automatic tax calculation and collection for you.

How to record and document sales tax activity

If there’s one thing bureaucracy loves, it’s proper documentation. So if you’re going to all the trouble of complying with tax registration and tax calculation, then you should definitely keep accurate, clear records about it, too!

Issue tax-compliant receipts

Many countries have requirements about what information to include on your receipts or invoices to comply with tax laws. Basically, these receipts (or invoices) include all the information tax authorities would want to see in an audit. Tax receipts are also the required documents for claiming any tax deductions when you file.

So a great practice to have in your business is to issue proper tax receipts, generated from a template that works for any country.

A full tax receipt should include the following pieces of information:

- Your business name and address

- Your tax registration number

- The name and address of the buyer, whether company or private customer

- A unique invoice reference number that can only refer to the invoice in question

- A date, usually the date the invoice was created

- A list of the products and/or services you’ve provided. (List these line by line, with a quantity and separate cost for each)

- The amount of sales tax, VAT, or GST for each item — or the total tax amount for the whole invoice, if every item is subject to the same rate

- The total amount of the invoice

- The payment terms, such as how long a customer has to pay, the channel of payment, etc.

Refunds and credit notes

When a customer has paid an invoice, and you want to give back the full payment or a partial amount, you must issue a refund with a credit note. A credit note reads much like a tax receipt, but it’s documenting the return of money.

Seems simple and obvious enough, but credit notes are very important to your business! Since they officially record the return of money, they are legal proof that you don’t owe taxes on that sale. Staying on top of credit notes can help you avoid paying too much VAT, GST, or other sales tax when filing comes around.

Keep safe (and digital) records for several years

Finally, it’s a good idea to keep your records in secure, digital storage. Some governments even require it. As mentioned above, the EU requires you to store customer location evidence, digitally, for ten years. That way it’s easy for you to produce records in the case of an audit.

In fact, digital tax records are rapidly becoming the norm. Thanks to the gradual digitalization of taxes, all businesses and individuals will be expected to pay, store, and file all tax documents online.

How to file sales tax returns

Before you think about how to maximize your business tax returns, you should figure out exactly how the returns work, depending on where you’re filing. When, how often, and just…how?

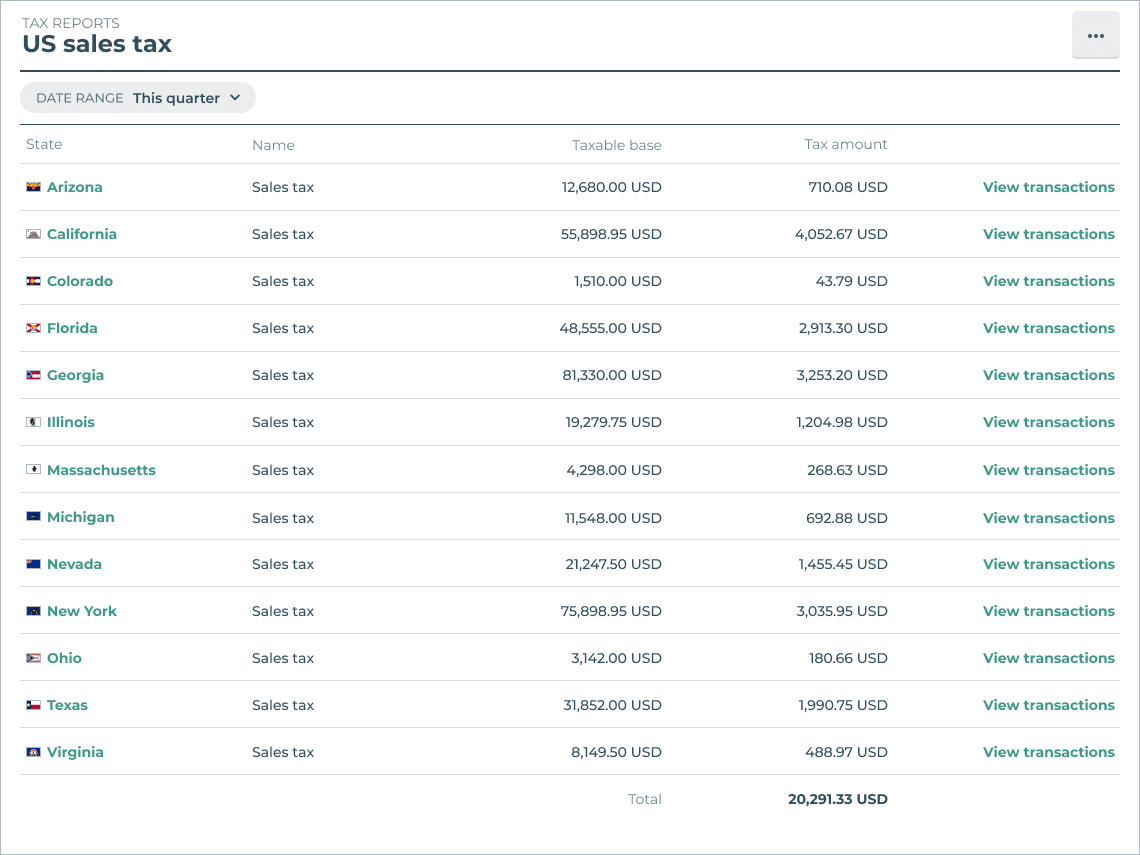

In US: File tax returns for each state separately, at different intervals

You can file state sales tax returns online at the state’s Department of Revenue website. But all the preparation before you get to that point is pretty complicated.

- Note of the frequency of returns. Is it monthly, quarterly, annually? Generally the more you sell in a state, the more frequently they want you to file. So actually the frequency of your filing can be subject to change!

- Note the deadlines for filing. Most states expect you to file by the 20th day of the following month, but this fluctuates a bit.

- Note the breakdown of tax reporting you need to provide. Some state sales tax returns don’t just want to know how much tax you collected in the state generally. They want tax collection broken down by county, city, and any other locality. Keeping clear records will help you on this point!

Important: Didn’t sell anything this year? Yes, you still have to file. File “zero reports” if you didn’t collect anything in a certain jurisdiction where you’re registered with a tax permit. This is an obligatory check-in!

In EU: File a VAT OSS return every quarter

EU’s rules are much more uniform. You submit one EU VAT return to your OSS at the end of each quarter. Every three months, four times a year, you get the idea. From the last day of each quarter, you have 20 days to file and pay. So the deadlines are as follows:

- 20 April, for the first quarter ending March 31

- 20 July, for the second quarter ending June 30

- 20 October, for the third quarter ending September 30

- 20 January, for the fourth quarter ending December 31

Submit your return online. You’ll need your records of VAT invoices to complete the filing.

Important note: If you made any sales in a different currency (i.e. – in the Danish Krone, but your OSS uses the Euro), you need to convert those amounts to the official currency of your OSS. Use the European Central Bank’s official exchange rates.

Based on the information you enter, the OSS website automatically calculates how much VAT you owe. Then you receive instructions on how to complete the payment, which is usually a simple bank transfer.

For more detailed instructions, read our guide about How to submit a VAT OSS return as a Non-EU business.

In other countries

Each country has its own filing frequency. Some let you file online, through the online portal, while others might use hard paper forms. And of course, wherever you hire a local tax representative, those tax returns will be filed for you.

For more detailed information about tax laws and processes in other countries, check out these deep-dives:

Accounting and tax compliance

An important part of effective tax planning and tax compliance is following proper accounting methods for your business model. Clear books help you understand what money is coming in, what’s revenue and what’s input taxes, what’s yours and what actually belongs to the government.

These methods include the Generally Accepted Accounting Principles (GAAP), nearly aligned with the International Financial Reporting Standards (IFRS), which all businesses should follow. A couple are specific to businesses who have recurring revenue.

Accrual Accounting

Accrual accounting differentiates between when payments are made versus when service is actually provided. According to the IRS:

Under the accrual method, you generally report income in the tax year you earn it, regardless of when payment is received. You deduct expenses in the tax year you incur them, regardless of when payment is made.

Accrual accounting is important because in a subscription business model, payments are made upfront for service that is meted out over time. You recognize revenue as you provide the service. Accrual accounting reflects all of this accurately.

Example: It’s April. You earned $100 revenue by providing your service, but you were paid for it in March. You received a $100 bill for office utilities, but you won’t pay it until May. Both these amounts are attributed to the month of April, matched in the proper month where they’re incurred, rather than March and May.

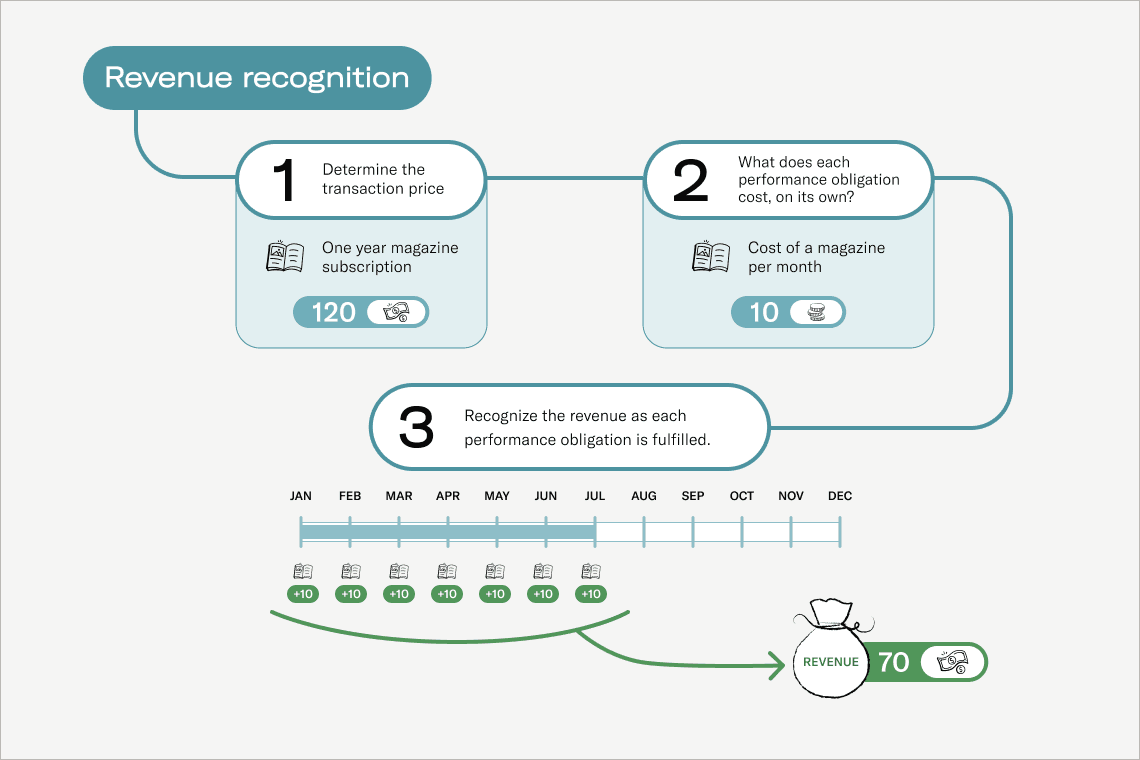

Revenue Recognition

Revenue recognition is closely related to accrual accounting. Although you receive a contract payment all at once, you can earn it only in pieces. Although you receive the March subscription payment on March 1, you earn it once the month is over. So, you recognize the revenue as you provide the service, as you fulfill the obligations laid out in the contract.

Revenue recognition shapes how you perceive your business’s performance and especially how you report your business’s performance.

According to the Financial Accounting Standards Board (FASB) , the purpose of revenue recognition is “to report useful information to users of financial statements about the nature, amount, timing, and uncertainty of revenue from contracts with customers.”

Expense records

Proper accounting can also help you minimize your tax obligations and save you money in the long run. A key practice to implement in your digital business? Record your expenses and claim them during tax season! What you can claim will vary from country to country (and state to state, in the US), but here’s a general list of some purchases that might qualify:

- Equipment for your business

- Marketing costs

- Home office costs

- Utilities and insurance

- Software or other membership services required to run your business

- Vehicle mileage and travel costs

- Charitable donations

- Contributions to retirement schemes

- Entertaining clients

Last word

The taxability of your digital product can be tricky to figure out, especially if you sell internationally and need to keep track of digital tax laws around the world. Plus, once you’ve determined that you are indeed liable for taxes, then you need to figure out how to comply!

While every business owner should be fully informed about tax compliance, no one should have to manage all the tedious steps on their own.

And while hiring a tax advisor is always a good idea when you have a specific challenge, there are parts of day-to-day tax compliance that can (and should) be automated by software.

Quaderno is one such software. We offer a tax management platform for digital businesses who want to grow without memorizing all the tax policies at home or abroad. From tax calculation and tax receipts to threshold alerts and comprehensive tax reports, Quaderno automates sales tax compliance for US sales tax, VAT, and GST around the world.

In fact, Quaderno can do all of the following:

- Calculate the right amount of tax to charge each customer, right on your checkout page.

- Alert you when you are approaching a tax registration threshold.

- Notify you when any tax policies or tax rates change, so that you’re always in the loop.

- Provide instant tax reports that will help you file tax returns in a few minutes.

- Automatically verify business numbers you receive from B2B customers.

- Collect and store the customer location evidence from every sale.

- Create tax receipts in multiple languages and currencies.

- Send tax receipts automatically.

Give us a try through our free trial.

Note: At Quaderno we love providing helpful information and best practices about taxes, but we are not certified tax advisors. For further help, or if you are ever in doubt, please consult a professional tax advisor or the official Department of Revenue.