Tax compliance software for digital creators

Quaderno provides the tools you need to sell globally without stressing about tax compliance.

Quaderno provides the tools you need to sell globally without stressing about tax compliance.

Use Quaderno's tax compliance software to simplify your tax processes and stay compliant, so you can focus on the work you love.

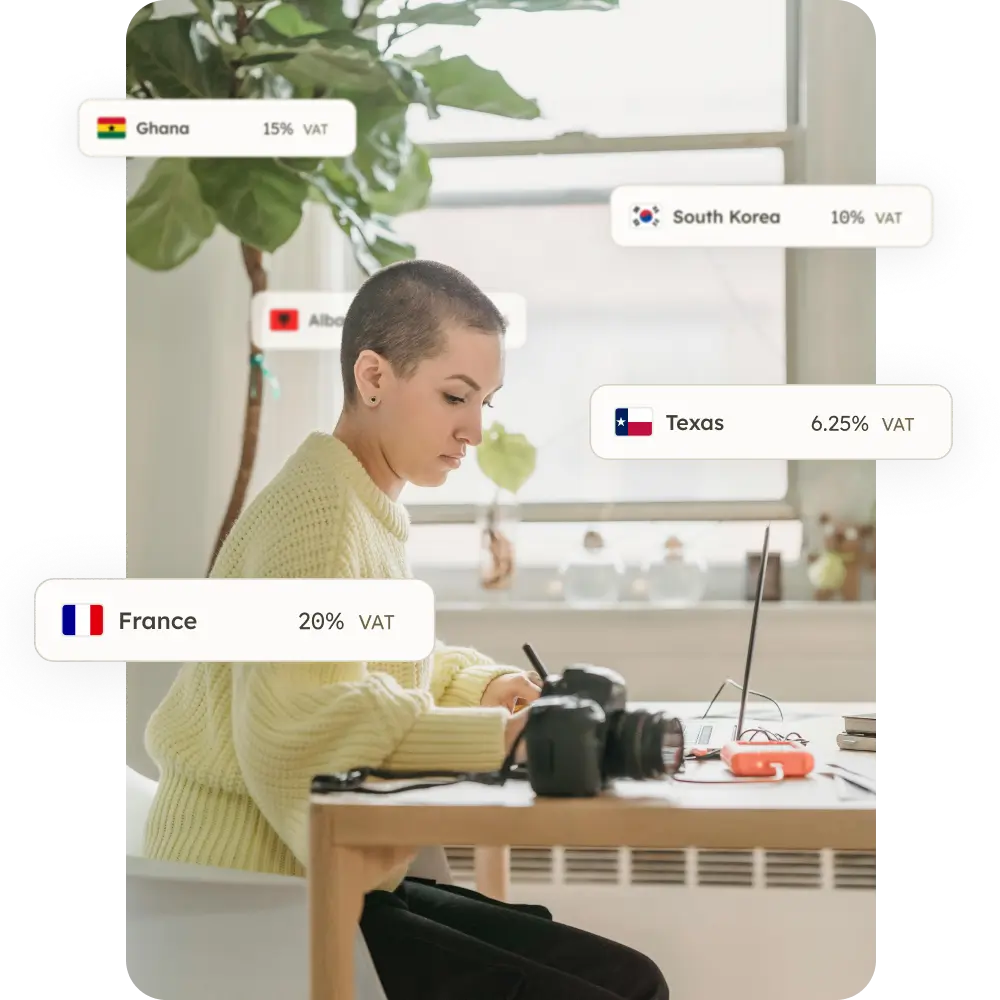

Quaderno monitors US economic nexus, VAT & GST thresholds in real time, based on your sales data. New registrations are taken care of automatically.

Quaderno supports over 12,000 tax jurisdictions worldwide. Every sale automatically has the correct local tax rate, based on your customer's location and the product category.

Never create a manual invoice again! Quaderno saves you time and reduces stress. Our invoices always comply with local tax regulations, no matter where you sell.

Quaderno Reports provide the transaction data you need to file VAT, GST, and sales tax returns seamlessly on your own. Or our filing service can do it for you automatically!

Dealing with taxes, such as EU VAT, is a major pain in the ass. I want to grow my business, not figure out what tax to charge. Fortunately, Quaderno takes care of it all for me.

Import your sales data to keep Quaderno completely up-to-date on your business! You can connect your go-to sales platforms using one of our native integrations, import a CSV file or use our API.

Check out our resource library for more information on your business tax obligations.

Explore the world of digital products with our comprehensive guide. Learn key definitions, selling tips, and tax compliance strategies to boost your online business.

Learn how to check if a company is VAT registered in countries around the world by using VAT lookup tools or tax compliance automation software.

Sales tax on digital goods by state is tricky. Which states have sales tax? What's taxable? Learn everything here.

See how Quaderno Checkout works with your shop, or create an account to get started right away!